Don't Let These Accounting Errors Drain Your Limited Company's Finances

Accounting Errors to Avoid as a Limited Company

Author - Craig Davies

Date - 18 June 2024

Even the most diligent business owners can fall prey to accounting errors. These seemingly small mistakes can snowball into significant financial losses for limited companies. Mismanaged finances can lead to cash flow problems, penalties, and even legal issues.

Simpler Tax is your trusted partner in helping you identify and avoid common accounting pitfalls. By implementing sound financial practices, with our guidance, you can protect your company's bottom line and ensure long-term success.

The Common Mistakes

1. Mixing Personal and Business Finances

- Explanation: Using personal accounts for business expenses or vice versa can create a tangled mess come tax time. It's one of the most common accounting mistakes we see with small business owners.

- Consequence: Mixing personal and business finances can lead to inaccurate financial reporting, difficulty claiming legitimate business expenses on your tax return, and potential tax penalties from HMRC. For instance, if you use your personal credit card for a business expense, you might not be able to claim it as a tax deduction, leading to higher tax payments.

- Solution: Rest assured, maintaining separate bank accounts and credit cards for personal and business use is a proven method. This clear separation simplifies accounts preparation and ensures accurate record-keeping, giving you peace of mind.

2. Neglecting Regular Bookkeeping

- Explanation: You need to keep up-to-date records of income, expenses, and assets to accurately track your company's financial health.

- Consequence: You may miss out on tax deductions, make poor financial decisions based on incomplete data, and face penalties for late or incorrect filings, including your VAT return and tax return.

- Solution: Establish a consistent bookkeeping routine in-house or by outsourcing to a professional. Consider using

accounting software to streamline the process and ensure accuracy. If you're unsure where to start,

contact us for advice.

3. Incorrectly Classifying Expenses

- Explanation: Miscategorising expenses refers to assigning an expense to the wrong category in your financial records. For example, if you categorise a business lunch as a 'personal expense ', it could lead to overstated or understated profits, directly affecting your tax liability.

- Consequence: It can result in paying more corporation tax than necessary or facing penalties for underreporting income.

- Solution: Familiarise yourself with HMRC's guidelines on allowable expenses and seek professional advice from an accountant if unsure. Simpler Tax's Accounts Preparation service can ensure your expenses are correctly classified and you claim all eligible deductions.

4. Ignoring VAT Regulations

- Explanation: Value Added Tax (VAT) is a complex area of UK tax regulations, and errors in calculating or reporting VAT can be costly.

- Consequence: Incorrect VAT returns can lead to penalties, interest charges, and even investigations by HMRC.

- Solution: Understand your VAT obligations, keep meticulous records, and consider using accounting software to automate VAT calculations. Simpler Tax offers comprehensive Factsheets to VAT for Limited Companies to help you understand the rules and avoid costly mistakes. If you need assistance with your VAT return, our experts are ready to help.

5. Failing to Reconcile Bank Statements

- Explanation: Not regularly comparing your bank statements with your accounting records can lead to undetected errors and discrepancies.

- Consequence: You may miss unauthorised transactions, bank errors, or even fraudulent activity, which can negatively impact your company's financial health.

- Solution: Reconcile your bank statements monthly. This involves comparing the transactions in your bank statement with those in your accounting records to ensure they match. If there are any discrepancies, you can identify and correct them promptly. This simple step can save you significant headaches down the line.

6. Failure to claim all expenses due

- There are lots of additional expenses you can reclaim Simpler Tax will ensure we understand your business and claim all relevant expenses for you.

- This is important to lower your tax but also just as important increase your disposable income, so you have more money for your own use.

Conclusion

Proactive financial management is essential for the success of your limited company. By avoiding these common accounting mistakes and implementing sound financial practices, you can protect your company's financial health and ensure its long-term growth.

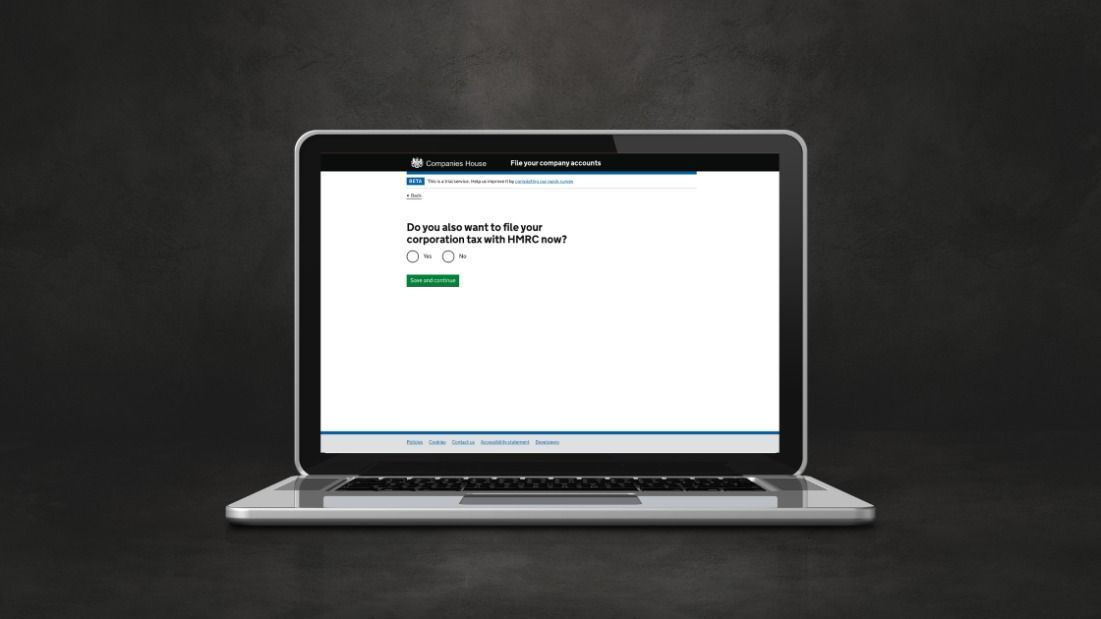

Simpler Tax understands the complexities of limited company accounting and UK tax regulations. We offer various services, including Accounts Preparation, which involves preparing your company's financial statements, VAT return filing, which ensures you meet your VAT obligations and avoid penalties, and tax return preparation, which helps you accurately report your income and claim all eligible deductions. These services can help you stay compliant and make informed financial decisions.

Don't let accounting errors hold your business back. Contact Simpler Tax today for expert advice and support to safeguard your financial future. Take the first step towards proactive financial management and protect your company's financial health.