The Top 10 Benefits of Outsourcing Your Accounts Preparation

Why you should be getting a professional to prepare your accounts

In today's fast-paced business world, time is a precious commodity. As a business owner, you're constantly juggling multiple responsibilities, and it's easy to feel overwhelmed. One area where you can significantly streamline your operations and free up valuable time is by outsourcing your accounts preparation to Simpler Tax. In this blog post, we'll explore the top 10 benefits of entrusting this crucial task to our experts.

1. Expertise and Accuracy

Accurate financial records are integral for informed decision-making and ensuring compliance with HMRC regulations. At Simpler Tax, our team of qualified accountants meticulously prepares your accounts, giving you the confidence to make strategic choices and avoid costly errors.

2. Time Savings

Accounts preparation can be a time-consuming process, diverting your attention from core business activities. Outsourcing to Simpler Tax frees up your valuable time, allowing you to focus on what you do best - growing your business and serving your customers.

3. Cost Efficiency

Hiring in-house accounting staff involves significant costs, including salaries, benefits, office space, and software. Outsourcing to Simpler Tax provides a cost-effective alternative, eliminating these overheads and offering transparent, predictable pricing.

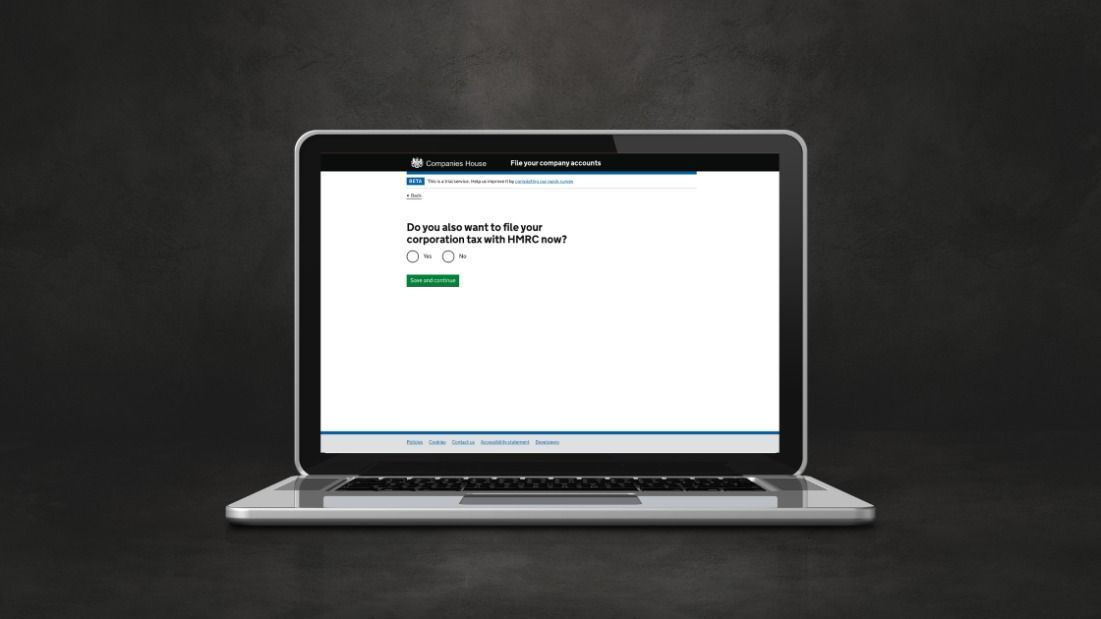

4. Access to Latest Technology

Simpler Tax invests in cutting-edge accounting software, ensuring your accounts are managed with the most up-to-date tools. Benefit from automation, streamlined processes, and real-time financial insights to stay ahead of the curve.

5. Scalability

Your business growth goes hand in hand with your accounting needs. As one grows, so does the other. Simpler Tax's services are designed to scale seamlessly with your business, providing the flexibility and support you need at every stage of your journey.

6. Reduced Stress

Managing finances can be a stressful endeavour, especially when compliance is at stake. Outsourcing to Simpler Tax alleviates this burden, giving you peace of mind knowing your accounts are in capable hands and allowing you to focus on other aspects of your business.

7. Improved Compliance

Staying compliant with UK tax regulations is crucial to avoid penalties and fines. Simpler Tax's expertise ensures your accounts are prepared in accordance with HMRC guidelines, keeping your business on the right side of the law.

8. Strategic Insights

Beyond compliance, Simpler Tax's experienced accountants help you make informed business decisions by offering valuable financial advice. Gain strategic insights into your financial performance and identify opportunities for growth and improvement.

9. Data Security

We understand the importance of data security. Simpler Tax employs robust security measures to protect your sensitive financial information, giving you confidence that your data is safe and confidential.

10. Focus on Growth

Outsourcing your accounts preparation to Simpler Tax gives you crucial time to focus on what truly matters - growing your business. Leave the complexities of accounting to the experts and unlock your full potential.

Experience the Simpler Tax difference and discover how outsourcing your accounts preparation can transform your business. Contact us today for a free consultation and take the first step towards stress-free accounting. Don't miss this opportunity to streamline your operations and focus on your business growth.