by Craig Davies

•

22 November 2024

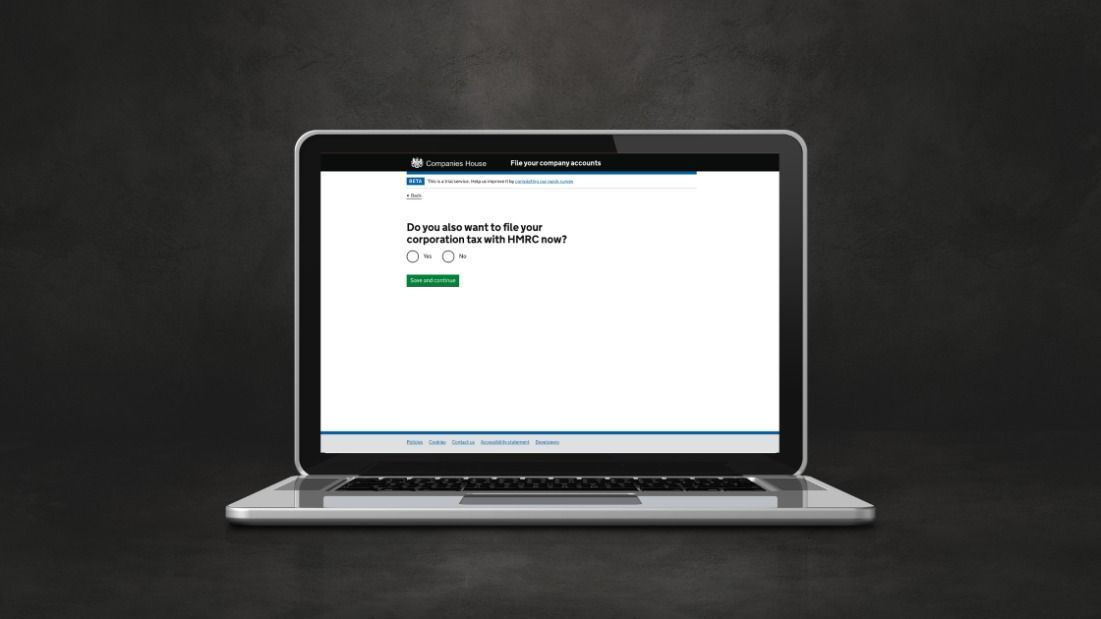

Drowning in Spreadsheets? Why Accounting Software is Your Business's New Best Friend Are you still relying on spreadsheets and manual calculations to manage your business finances? While spreadsheets have their place, they can quickly become a tangled mess, leaving you vulnerable to errors, wasted time, and missed opportunities. It's time to embrace the power of accounting software . Why Make the Switch? Here's how accounting software can revolutionise your financial management: Save Time and Boost Efficiency: Automate tasks like invoicing, expense tracking, and bank reconciliation. No more manual data entry or tedious calculations! Reduce Errors: Say goodbye to costly human errors. Accounting software ensures accuracy and consistency in your financial data. Gain Real-Time Insights: Access up-to-date financial reports with just a few clicks. Monitor your cash flow, profitability, and overall financial health in real-time. Improve Decision-Making: Make informed business decisions based on accurate and timely financial data. Simplify Tax Time: Generate tax reports with ease and ensure compliance with tax regulations. Enhance Collaboration: Share access with your accountant or team members, facilitating seamless collaboration and communication. Choosing the Right Software With so many options available, finding the right accounting software can feel overwhelming. Consider these factors: Business Size and Needs: Choose software that scales with your business and offers the features you need, whether you're a freelancer, a small business, or a growing enterprise. Ease of Use: Opt for user-friendly software with intuitive interfaces and readily available support. Integration with Other Tools: Ensure the software integrates with your existing business tools, such as your CRM or payment gateway. Budget: Explore pricing plans and choose a solution that fits your budget. Popular Accounting Software Options Xero: A cloud-based accounting solution popular with small businesses and freelancers. Quickbooks: A comprehensive accounting software with options for both online and desktop use. Used by many limited companies . Sage: A well-established accounting software provider with solutions for businesses of all sizes. FreeAgent: A user-friendly online accounting software designed for freelancers and small businesses. Making the Transition Switching to accounting software can seem daunting, but with the right support, the process can be smooth and stress-free. Data Migration : Many software providers offer data migration services to help you transfer your existing financial data. Training and Support: Take advantage of tutorials, online resources, and customer support to get up to speed quickly. Ready to ditch the spreadsheets and embrace the future of financial management? Contact Simpler Tax today for expert advice on choosing the right accounting software for your business. We can help you select the perfect solution, set up your account, and provide ongoing support to ensure you're maximising the benefits of your new accounting software.